Home-based Care M&a Rebounds In 2025, Highest Level In 2 Years

After a muted 2024, home-based care dealmaking shifted into a higher gear in Q1 2025.

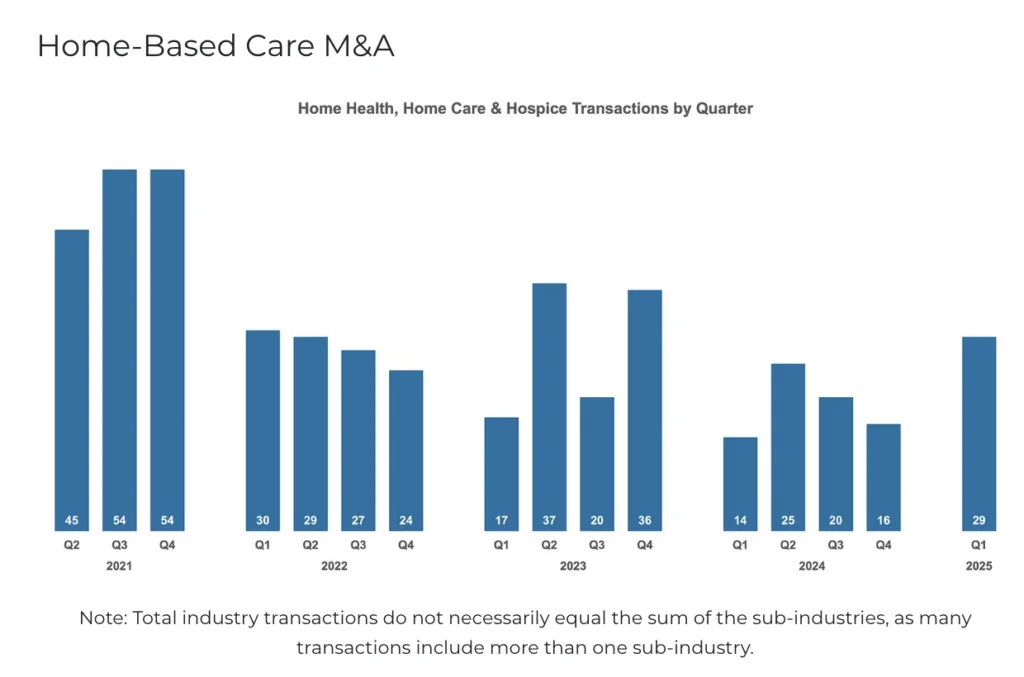

The first three months of 2025 were the most active quarter for industry M&A since 2023, driven largely by personal care, according to a new report from Mertz Taggart. While the increase in dealmaking marks an uptick from 2024, it’s unclear how long the shift will last.

“Deal activity is definitely picking up,” Cory Mertz, managing partner at Mertz Taggart, told Home Health Care News. “When I say deal activity, I’m not just talking about closed deals on the ground. More deals are moving forward than we saw a year ago, for sure. There’s definitely momentum. Hard to know yet though, if Q1 was a little bit of a spiky outlier.”

Q1 saw 29 home-based care and hospice transactions close, compared to 14 in Q1 of 2024. Some of the Q1 deal influx was caused by lingering deals that were slated to close in 2024 but pushed to the beginning of 2025, Mertz said.

Eight deals closed in the home health sector, while 17 stemmed from the home care industry.

Demand for home health is at an eight on a scale of one to 10, Mertz said in the report. Risk and uncertainty levels are relatively low in home health, and can play a role in buyers’ value-based care strategies.

While uncertainty is present regarding potential cuts to Medicaid, buyers were not dissuaded from closing home care deals. The number of home care deals was almost double compared to Q4 2024.

Eleven of the 17 home care deals closed in Q1 were funded by Medicaid. One notable example was the March acquisition of BrightStar Care by an affiliate of Peak Rock Capital.

While Q1 represented a positive upswing in home-based care dealmaking, predicting deal volume in future quarters is difficult because of economic “chaos,” Bruce Vanderlaan, managing director at Mertz Taggart, told HHCN.

“That makes it really hard to make a prediction, but at the same time, I’m seeing a lot of activity, Vanderlaan said. “We just came out of a historically low period of M&A activity, so there’s a lot of pent-up demand.”

Still, the fundamental drivers of dealmaking persist, Mertz said. Home-based care remains an attractive sector for investors, largely private equity-backed strategic portfolio companies, who have a “substantial” amount of cash to deploy.

Another key driver that could sustain elevated dealmaking levels is the aging of private equity funds with significant dry powder. These funds are eager to put dry powder to work through platform deals and strategic add-ons.

The post Home-Based Care M&A Rebounds In 2025, Highest Level In 2 Years appeared first on Home Health Care News.

Popular Products

-

Adjustable Cosmetic Denture Set

Adjustable Cosmetic Denture Set$48.99$33.78 -

Unisex Adjustable Back Posture Corrector

Unisex Adjustable Back Posture Corrector$71.56$35.78 -

Hydra Exfoliation, Extraction, and Re...

Hydra Exfoliation, Extraction, and Re...$3,218.99$1926.78 -

Neoprene Swim Fin Socks for Diving & ...

Neoprene Swim Fin Socks for Diving & ...$28.99$19.78 -

3D Compression Ankle Support Strap fo...

3D Compression Ankle Support Strap fo...$15.99$10.78