Posthaste: Canada Home Prices Are Heading Into Correction Territory

A home price correction is taking place in Canada, especially in the country’s most expensive markets, say real estate watchers.

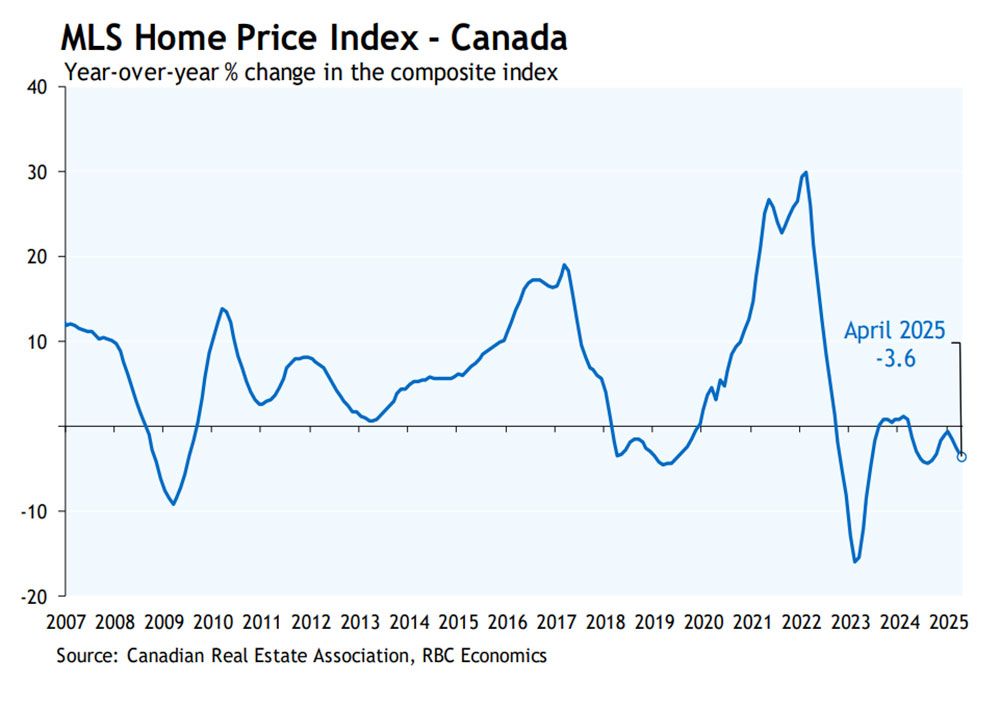

Canada’s composite MLS home price index fell for a fifth consecutive month in April, down 1.2 per cent from March and 3.6 per cent from the year before, said Robert Hogue, assistant chief economist at Royal Bank of Canada.

“Softening supply-demand conditions have triggered a price correction that could persist,” said Hogue in a report.

Ontario is taking the brunt of it, with every market posting month-over-month declines. Toronto’s composite home price index has fallen 6.2 per cent over five months, but other markets are taking even bigger hits. In London, Ont., prices are down 7.7 per cent, in Kitchener-Waterloo, 7.6 per cent, Niagara, 6.9 per cent and Hamilton, 6.5 per cent.

British Columbia is also showing weakness with Vancouver and Fraser Valley posting 2.8 per cent composite price drop over four months.

Condos are leading the price decline in both markets. Toronto’s condo MLS home price index is now down 7.3 per cent annually, said Hogue, with Vancouver’s down 2 per cent.

“Rising inventories have shifted market dynamics decisively in buyers’ favour throughout Ontario and B.C., creating some of the most buyer-friendly conditions in decades,” said Hogue.

Other markets in Alberta, Saskatchewan, Manitoba, Quebec and Atlantic Canada remain fairly tight and have been able to retain modest price growth.

The good news is that the dampening effect of trade tension on home buying may be nearing its peak, said Hogue.

National home sales steadied in April, down just 0.1 per cent from the month before after a sharp 19 per cent drop over the past four months.

“The U.S. administration’s decision to spare Canada from additional tariffs last month could boost confidence and attract buyers in coming months,” he said.

So far the Bank of Canada has had little to say about the housing market slowdown , but economists with Capital Economics think that the weakness is becoming harder to ignore.

Even if the market stabilizes in coming months, Capital predicts the central bank will make a couple more interest rate cuts this year.

Sign up here to get Posthaste delivered straight to your inbox.

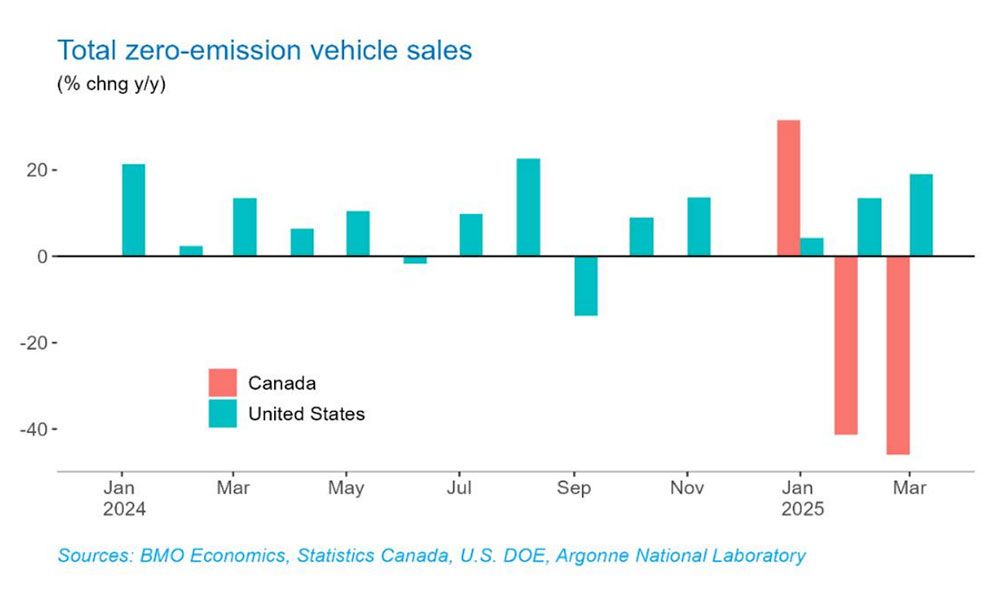

Ouch, a rebate goes a long way in the EV market. Today’s chart shows how zero-emission new vehicle sales plunged 46 per cent in March and 41 per cent in February after both federal and Quebec governments paused their EV rebate programs in January, said Erik Johnson, senior economist at BMO Capital Markets. Quebec has since reinstated its rebates on April 1, but B.C.’s ended May 15.

Quebec sales were down 67 per cent in March, but time will tell if the return of the rebate brings customers back.

South the border EV sales went in the other direction, but higher prices from tariffs and the phasing out of EV tax credits in the Republicans’ budget could slow sales by the end of the year.

- G7 finance ministers and Central Bank governors meet in Banff, Alberta, to discuss issues impacting global economic stability and growth ahead of the 2025 G7 Leaders’ Summit, which will be held in Kananaskis, Alberta, from June 15 to 17.

- Today’s Data: Canada inflation

- Earnings: The Home Depot Inc

- Federal debt isn’t some abstract, distant problem, as mortgage borrowers may soon find out

- When riding the market whiplash, structured notes can smooth the journey

- ‘Buy Canadian’ boosts local beauty industry. Will tariffs end up reversing that?

It can feel incredibly isolating when you are struggling to make ends meet and your bank or credit union is unable to approve your application for a debt consolidation loan. However, it’s important to know that there are other effective strategies to help you regain control of your finances, many of which don’t require borrowing more money. Mary Castillo walk us through them.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com .

- Developers lament construction costs in Canada, but it could be a lot worse

- Just when you thought Toronto's condo market couldn't get any worse …

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here