Guest Post – Reset With Purpose: Navigating Csrd And The Next Chapter In Sustainability

By: Esther Toth, Senior Industry Principal of Sustainability at Workiva

The European Commission’s proposed Omnibus Simplification Package aims to streamline sustainability-related due diligence and reporting and limit mandatory disclosure to only the largest companies. However, the Commission insists these changes won’t alter the EU’s decarbonization goals or broader ambitions around the net zero transition and clean industrial strategy.

Ahead of the EU’s Omnibus package, over 200 financial sector organizations, including 162 asset owners and asset managers, urged policymakers not to dilute the Corporate Sustainability Reporting Directive (CSRD). While supporting simplification, they warned that weakening key elements of the CSRD risks undermining the high-quality, comparable data essential for informed investment decisions. The Dutch Financial Markets Authority (AFM) echoed this in March 2025, cautioning that scaling back reporting requirements for reporting or assurance could erode trust in the data. These worries are not unfounded. FTSE Russell’s 2024 survey reinforced that 90% of global asset owners view sustainability data as critical to decision-making, but over half cited ongoing issues with data consistency and comparability.

The EU’s Omnibus Shift: Pausing, Streamlining, Simplifying

Introduced in February 2025, the Omnibus I package includes two proposals that recalibrate Europe’s sustainability reporting scope and timeline. For sustainability teams, it presents both relief and uncertainty.

The first, “Stop the Clock Proposal,” pauses the expansion of the CSRD’s scope beyond current Wave 1 companies, which are large, listed EU firms and public interest entities already subject to the Non-Financial Reporting Directive. This proposal has been formally adopted by both the European Council and the European Parliament, effectively formalizing the delay for companies beyond Wave 1. On April 14th, the final text was published in the Official Journal of the European Union and member states have until the end of 2025 to transpose it into national law.

The second, “Substantive Proposal,” would simplify sustainability reporting by reducing complexity, prioritizing quantitative data, and raising the threshold for in-scope companies. According to the proposed thresholds, only companies with more than 1,000 employees would be required to report. These changes, while still under negotiation, would significantly reduce the number of companies in scope for mandatory reporting.

Meanwhile, the European Commission has asked EFRAG to deliver a simplified and streamlined version of the European Sustainability Reporting Standards (ESRS) by late October 2025. EFRAG has already launched a public consultation seeking feedback on materiality assessments, narrative disclosures, and unclear or overlapping requirements. Stakeholders have until May 6, 2025, to respond.

Riding the First Wave of CSRD Reporting and Raising the Bar on Governance

Leading businesses are increasingly embedding robust governance practices, data controls, and accountability into the way they manage and report sustainability-related performance. According to Workiva’s 2025 Executive Benchmark on Integrated Reporting, 97% of corporate executives affirm that having a strong sustainability program will become a competitive advantage within two years, while 96% of investors agree it strengthens financial performance.

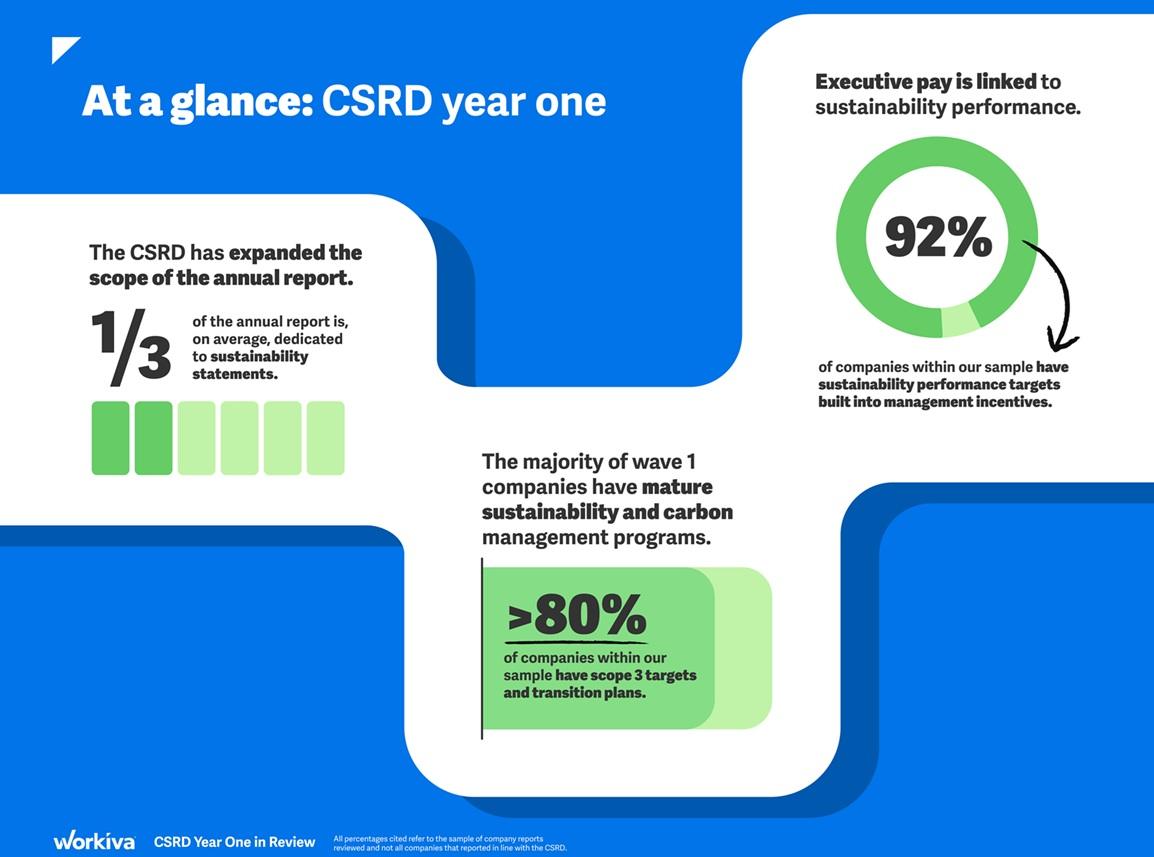

As the first wave of CSRD-compliant reports emerges across Europe, Workiva’s analysis of 50 Wave 1 companies reveals significant advancements in sustainability governance, decision-useful data and standardized disclosures.

- GOV-1: Strengthening Governance Structures for Sustainability

Workiva’s research shows that most Wave 1 companies have embedded sustainability governance into both executive and board-level oversight. In particular, 92% link sustainability performance targets to management incentives, signaling that sustainability issues are no longer siloed but integrated into business strategy. GOV-1 disclosures also show that audit committees are increasingly responsible for overseeing materiality assessments and related sustainability disclosures. This marks a strategic shift in how companies manage environmental, social, and governance risks, moving from compliance to boardroom accountability. - GOV-5: Building Controls for Credibility

GOV-5 disclosures reveal that over 80% of companies have introduced internal processes to mitigate risks related to errors and misstatements in sustainability data. These measures are crucial for enhancing the credibility of sustainability reporting and for enabling informed, data-driven decision-making. As external assurance and scrutiny grow, these early investments in control frameworks are positioning companies to lead on both transparency and trust. - Impacts, Risks, and Opportunities (IRO) Reporting: Materiality in Motion

Workiva’s analysis revealed significant variation in how companies identify and report material sustainability-related IROs. Some companies reported just a dozen, while others listed close to 100 IROs. Some offer a clear and consolidated view of all IROs, while others disperse IROs across different sections of the report and link them more closely to reporting on performance metrics. While practices differ, the trend signals a major evolution: IRO reporting helps companies define what sustainability really means for their business. As the market matures, sector-level convergence and more consistent reporting practices are expected to emerge.

Navigating the Omnibus Changes: Key Decisions for EU and Non-EU Companies

While immediate reporting requirements for those already in scope remain unchanged, companies should proactively prepare by considering potential regulatory scenarios, alongside requirements and expectations from their key stakeholders, as well as peer and competitor good practices.

- Wave 1 EU large listed companies well above the proposed new threshold (entities with more than 1,000 employees and parent entities with more than 1,000 on a consolidated basis): Expect unchanged reporting obligations for FY2025. However, do monitor and anticipate the simplified ESRS to be adopted by the delegated act and mandated for future reporting periods.

- Wave 1 EU listed companies near or below the proposed threshold: Maintain consistency in reporting through FY2025. Closely monitor EU legislative developments as new thresholds become finalized. If ultimately exempted after FY2026, companies can consider adjusting reporting strategies accordingly.

- NEW Wave 2 EU large private companies well above the proposed new threshold: Use the additional preparation time wisely before your first CSRD-compliant report (expected for FY2027). Your first fully ESRS-aligned report will likely require limited assurance and possibly also digital tagging of non-financial information. If FY2025 reporting under the original CSRD mandate would have caused any challenges, then use this time proactively to refine governance, double materiality, and build assurance-readiness.

- All other EU companies (e.g., listed SMEs or private companies well below threshold): Evaluate whether your current financial and sustainability disclosures sufficiently align with evolving expectations from customers, lenders, investors, and other business partners. Consider alignment with a simplified voluntary reporting standard to be adopted by the Commission, based on the voluntary standards for SMEs (VSME) developed by EFRAG.

- Non-EU companies with operations globally: Now is the time to conduct detailed, entity-level jurisdictional mapping. Subsidiaries or legal entities operating within the EU could be caught under local implementation. Beyond Europe, over 30 jurisdictions worldwide are at various stages of adopting or aligning with the ISSB Standards. Taking a proactive, globally coordinated approach to (double) materiality assessment, sustainability governance and data readiness will ensure you stay ahead of both regulatory expectations and stakeholder or market demands.

In short, the biggest risk may be indecision and inaction – a pause without purpose. Those who invest in sustainability now, guided by materiality and powered by trusted data, will be best positioned when momentum inevitably picks up. By leveraging powerful tools, having a disciplined focus on materiality, companies can confidently manage their sustainability performance, even amidst regulatory flux and market uncertainty.

About the author:

Esther Toth, senior industry principal of sustainability at Workiva, has more than 15 years of experience in corporate sustainability. In her current role, Toth leverages deep expertise to drive regional growth and advance the capabilities of Workiva, the world’s leading cloud platform for assured integrated reporting. For more information, visit workiva.com.